If you purchased property in 2019, you might be able to get money from the seller for their portion of the property taxes.

Counties in the state of Texas finalize and mailed out the final property tax bill in October. When properties are purchased, the title companies and the lender use the certified property tax value based on the prior year.

Per the TREC promulgated form, the property taxes (paragraph 13) are pro-rated between the buyer and the seller.

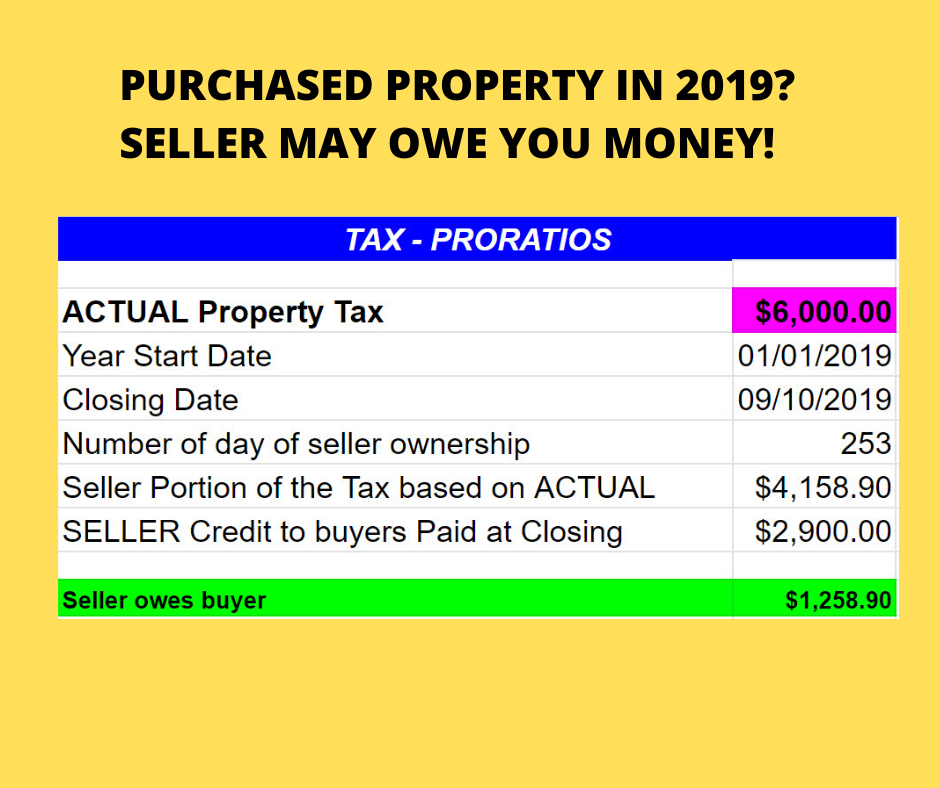

For example, let us say that you purchased the property on Sept 10, and the seller credited $2900 for their pro-rated tax based on 2018. Now you received the final property tax bill from the county for 2019 at $6000. Based on the final property tax bill, the sellers’ pro-rated tax amount would be $4158.90. Since they already credit $2900, they owe you the buyer an additional $1258.90.

Property tax pro-ratios survive closing, i.e., per contract, the seller has to pay the pro-rated tax amount. As a new owner, you are liable to pay the final amount to the county.

Who can help? Though the contract is between the buyer and the seller, your agent should be able to help.

If you are in the market to buy or sell, contact Poogle (972)4087402, an experienced and knowledgeable REALTOR(R).