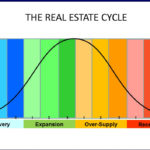

Every few years it’s interesting to review predictions about real estate cycles. The basic pattern of a real estate cycle is Recession, Recovery, Expansion, Over-supply, and Recession again. We’ve seen this playing out in real-time since 2008, when the market fell into a deep recession, followed by a robust recovery and a still-happening expansion.

Eventually, real estate prices will stabilize, and then some years away there will be another period of over-supply, called a buyer’s market.

How long do these cycles take and how extreme are they? No one can say for sure, but there are theories. For instance, there’s the “18-year real estate cycle,” touted by economist Homer Hoyt in the 1930s, and reiterated by Fred Foldvary, who accurately predicted the 2008 collapse of the real estate market (www.foldvary.net/works/dep08.pdf).

But such theories can be affected by war and weather, among other things. An 18-year cycle could easily become a 23-year or 15-year cycle, and be mild or severe. In decades past, the real estate market went for years at a stable 0% to 3% growth. By today’s standards, that might seem disastrous, but if that’s the extent of the next “downturn,” then that might not be so bad by comparison to 2008’s downturn.

Ultimately, real estate prices tend to rise over time, despite downturns. Your great-great-grandfather’s $5,000 cottage by the sea is now worth $500,000. Your parent’s tract home, bought for $40,000 in 1976 is now worth $145,000.

So, rather than basing home buying or selling decisions on macro real estate predictions, it’s better to make smart choices based on personal financial goals and current local market conditions.

Are you concerned about buying or selling? Talk to me about your plans and we’ll discuss solutions to meet your goals.